Here we will show why Inamon is so important for the insurance

company as well as the end customer, when we look at price

differentiation.

What is it?

Price differentiation is where you look at the risk you are

taking and setting the price accordingly. It is not a new thing, as

without it, the price would be the same for all cars and drivers,

and we all know that this is not the case.

Price differentiation rates on a large number of criteria

divided into two groups:

- Profile of the insured person and object, e.g. type of car, age

of driver, immobiliser, post code etc.

- Cover required, e.g. Comprehensive or Third party fire and

theft, Legal protection, Break down, Courtesy car etc.

A more granular example is a home policy where a customer may

have an option to be covered for Freezer Content. Those without a

freezer don't need that cover, and even if they do have a freezer,

they may not want the cover. The customer may want the cover, but

may want to decide how much it should cover. If you fill your

freezer with lobsters and fillet steaks, you need more cover than

if you just keep a few pizzas. You get the gist!

Many insurance companies offer free included cover of some kind.

It isn't free and often just a sign that they can't price

differentiate in their IT-systems.

Price differentiation can be seen in other industries such as

airlines, where some carriers charge for what you get, e.g. bags in

hull, food on board, priority boarding etc. Previously you would

pay for a service whether you wanted it or needed it.

The internet has created new opportunities for micro level

unbundling with computer based price calculations and where the

customer has the option of selecting exactly what is required, not

buying a "one size fits all" product.

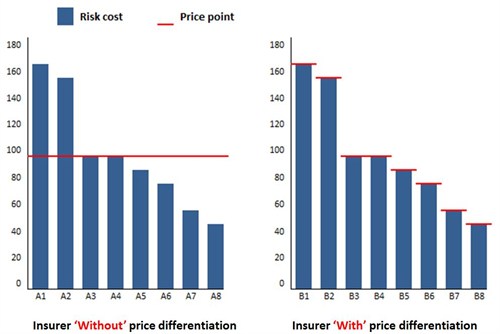

Below is an illustration of the impact on the insurance company

when using price differentiation and just as importantly when not

using it.

|

|

- Two insurance companies starts with the same portfolio mix

- One company charge the same price for all policies

- The other company charge according to the calculated risk

- We call them 'With' and

'Without'

|

|

|

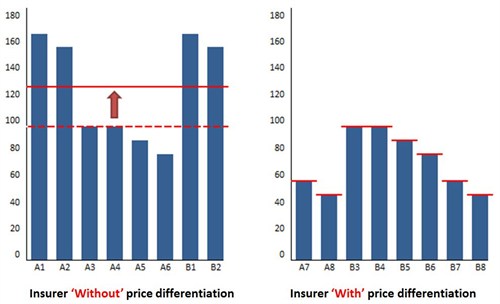

- Customers with policy A5, A6, A7 and A8 can get a better price

with 'With'

- Customers with policy B1 and B2 can get a better price with

'Without'

- A7, A8, B1 and B2 moves to the cheaper company

|

|

|

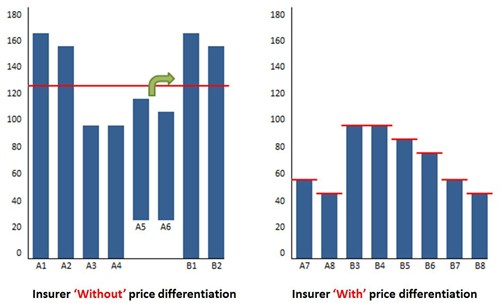

- 'Without' now have to

increase the price to remain profitable

- 'With' has lost some

revenue

|

|

|

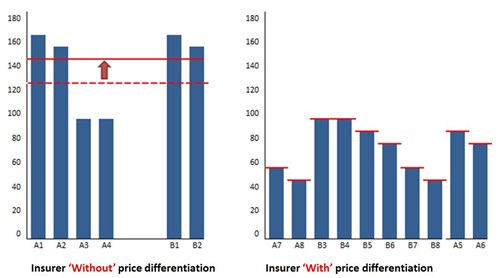

- Because of the price rise, more customers have had enough and

will move from 'Without' to

'With'

- No one wants to move to 'Without' anymore

|

|

|

- 'Without' now has to

increase the price again causing even more customers to leave

- 'With' ends up with higher

revenue as well as higher profitability

|

From the illustration above we can draw the following

conclusions:

- Customers will migrate to the company with the lowest

price

- Customers with a low risk will move to insurance companies with

high price differentiation

- Customers with a high risk will move to insurance companies

with low price differentiation

- Insurance companies with high price differentiation will

attract the good risks

- Insurance companies with low price differentiation will attract

the bad risks

- Insurance companies with low price differentiation will be

threatened in the long run, as they continue to increase prices to

cover their highest risks.

- Insurance companies with high price differentiation will have

better profitability and can continue to win business.

- In other words, use price

differentiation and prosper or don't use it and get

punished.

How Inamon can help?

At initial sale it is of course important that the customer can

buy exactly the required cover, and Inamon is perfectly geared to

that. The more the customer can visualise of the selected cover,

e.g. via slide-selection, the quicker the customer will understand

the available cover range and remember what the policy covers in

the end.

To actively select the cover levels makes it much more

transparent than having to find the limits in the terms and

conditions.

If the customer is buying a "one size fits all" product, it is

not likely that any changes to circumstances will require changes

to the policy, but if the customer buys a tailor made product, it

is very likely that changes to circumstances will require changes

to the policy.

This is where the self-service facilities of Inamon are so

important. The more price differentiation is used for a product,

the more changes to the cover is required when circumstances

changes. The more changes to the policy required, the more sense it

makes for the insurance company and the customer to use

self-service.

Amendments via call centres are costly, but self-service is free

and a win/win situation for customers and insurance companies.

An example of a change is when the customer buys a specified

item on holiday, e.g. a watch, and may only be covered when the

item is registered on the policy. The customer will have access to

the account and can update the policy accordingly, there and

then.

Conclusion

There is an accelerating trend towards more precise pricing for

risk, based on increasingly detailed personal information and where

the customer is only charged according to the risk they

represent.

Price has always been an important differentiator in the mass

market, but the rise of aggregators has made comprehensive price

comparison easy.

With margins under severe pressure, accurate pricing for risk

represents the principal strategy whereby insurers can hold onto

market share without seeing their profitability diminish to a low

level.

IT systems are essential in this process and must satisfy the

business goals of enabling granular rating as well as easy

adjustment of cover and circumstances.

Inamon does this better than any other solution.